2021 arguably turned out to be one of the best years for venture capital investments, both in terms of value and volume. While 2022 continued the momentum with India witnessing the birth of 14 new ‘unicorns’ (billion-dollar companies) in just the first quarter, one can argue that there is some scepticism in the markets. At Earlsfield Capital, we believe that while external funding and valuations will see cyclic shifts, there is a generation defining story playing out led by rapid digitization, in particular for developing economies.

Earlsfield Capital is a London-based, sector-agnostic technology investment platform, focused on investing in India and Southeast Asia. We invest in founders and companies that have the vision and executional capabilities to solve for large gaps in the market through the adoption & use of technology. At Earlsfield, we identify companies that are targeting a large & growing market, while building products and services that enable a tectonic shift towards digitization. Of course, above everything else, we look at founders, who believe they can make the world a better place. Here’s why we are believers in India, Southeast Asia and the digital transformation story:

Technology & Digitization

Technology has always been a powerful catalyst for change, disrupting traditional business practices and generating new economic value through time immemorial. The difference today is the sheer pervasiveness of technology in our lives, as well as the speed with which new innovations are developed and adopted. India & Southeast Asia are at the forefront of the new age of technology led by digitization, with over 1.5 billion people using data services on smart phones across both the geographies. As digital capabilities improve and connectivity becomes omnipresent, technology is poised to quickly and radically change nearly every sector in these regions.

Demographic Dividend

India and Southeast Asia have some of the youngest populations in the world, with a median age between 28-30, while developed countries like USA and China are almost a generation older at 37. According to the United Nations Population Fund’s report, India alone has ~350 million people between the ages of 14-25 years, which is more that the entire population of the USA. Over the next 15 years, the working population could potentially grow to ~1 billion. India and Southeast Asia have only just started to witness their decades of demographic dividend and the future looks promising, despite expected cyclical downturns.

Rural India

Most solutions, products and services, have historically catered to the slightly more affluent urban customer base, however, since 2016, we have seen a shift with the larger population coming online in masses. Per capita income in rural India, according to a PwC study, is expected to grow 3x between 2025-2030 and to put this into context, currently only 8% of the population earn more than $1500 a month, which is expected to move up to ~50% by 2025! The story playing out in rural India and Southeast Asia is fascinating, as products and services catering to this customer segment are significantly different and require a strong understanding of the customer mindset clubbed with localization.

Financial Inclusion

There is a large financial inclusion gap in the region. While Southeast Asia’s economy has come a long way in the last decade, a study by Bain highlighted that 6 out of 10 Southeast Asians still remain underbanked or unbanked today. As far as India is concerned, approximately 200 million Indians still don’t have access to a bank account. Micro, Small & Medium Enterprises (MSMEs), the backbones of the Indian and Southeast Asian economies, are the largest employers in their regions, contributing to almost ~45% of all employment, however, their growth is inhibited by the lack of access to credit and poor infrastructure.

The digitalization of financial services has provided new tools to solve persistent barriers to financial inclusion. We have witnessed several Financial Technology companies enter and disrupt the industry, making capital more attainable and affordable.

Other trends common to both regions besides a credit-starved population include a large rural population, a weak and underpenetrated education system, and sub-par healthcare and logistics infrastructure. These issues have created a substantial ‘white space’ that can be tapped into by companies and founders looking to create solutions that create a large positive impact on the lives of the masses.

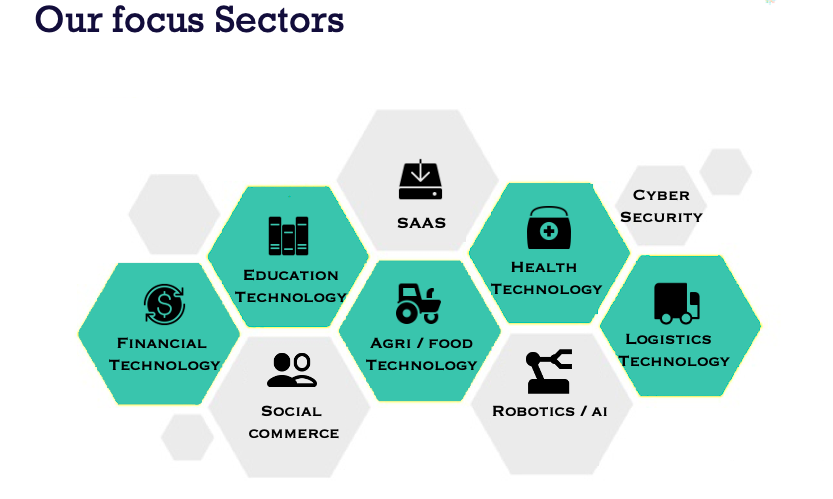

With the above trends in mind, we have closely analysed certain themes like financial services, healthcare, education, agriculture, logistics and supply chain, and various sub-sectors within them. We believe that these sectors have the potential for mass adoption and face imminent disruption by augmenting technology.

What we do

Now that you have an idea of who we are and how we’re looking at the technology landscape, here’s what we’ve done so far:

We follow a disciplined and process-driven approach, building a thesis of investable models by identifying future trends and opportunities within each focus sector. Given our understanding of the Indian and Southeast Asian landscape, we have closely studied certain sectors and sub-sectors in the regions and made over 25 strategic investments. These investments have been in varied sectors like Financial Technology, Healthcare Technology, Education Technology, Agricultural Technology, Logistics, and SaaS among others. You can check our portfolio here!

Why Earlsfield Capital?

Simply put, we are Capital++. So, what does Capital++ mean to us? Earlsfield Capital is led by entrepreneurs, who have built and scaled businesses themselves. Our leadership team has a global network that can be leveraged to help companies as they undergo challenging growth cycles. Our team understands the challenges faced while building a truly great company and offers perspective and/or expertise when called upon. While we are ‘hands-off’ we like to have enough knowledge and insights to provide value. We provide patient capital for companies to build responsibly and sustainably with the intention to partner with them for the long term. After all, it takes decades to build enduring organizations.

While we do look at everything while investing, we believe our North Star metric is not really a metric- it’s the founder(s) and the team. If we identify the right team, we are fortunate to get a seat on the Rocketship, and if things do not pan out as expected, at least we tried! The iconic Bruce Lee said- “Don’t fear failure — not failure, but low aim is the crime. In great attempts, it is glorious even to fail”.

At Earlsfield Capital, we’re always learning – from venture funds, founders, industry experts, market trends, and each other- we’re constantly evolving, as individuals and together. There has possibly been no better time to be in the ecosystem – as a founder, as a start-up employee, and dare we say, as venture capitalists too! It’s time to build towards a new future and we are ready to play our part! Reach out to us, we’re listening, intently.

#venture capital #venture capital firm #seed funding #startup funding #funding for startup #funding for my stratup

#venture capital startup #startup investing #investment related #seed capital