Responsible Investing

Responsible Investing

Job Creation

Technology has the potential to create millions of jobs. Our capital aids in creating jobs thereby improving lives and livelihood

Financial Inclusion

Earlsfield backed companies provide financial services and access to credit to the excluded low-income households

Combating Illiteracy

We are keen on models that enhance accessibility or quality of education

Improving Lives

We invest in businesses that are enabling the essential value chain and are improving the living and earning conditions of the lower income population

Job Creation

Technology has the potential to create millions of jobs. Our capital aids in creating jobs thereby improving lives and livelihood

Financial Inclusion

Earlsfield backed companies provide financial services and access to credit to the excluded low-income households

Combating Illiteracy

We are keen on models that enhance accessibility or quality of education

Improving Lives

We invest in businesses that are enabling the essential value chain and are improving the living and earning conditions of the lower income population

Our Responsible Investing Framework

We measure the success of our investments not only by financial outcomes, but by tangible, on-ground impact and opportunities created.

Our investments are focused on sectors that have a pressing need for deep impact

![]()

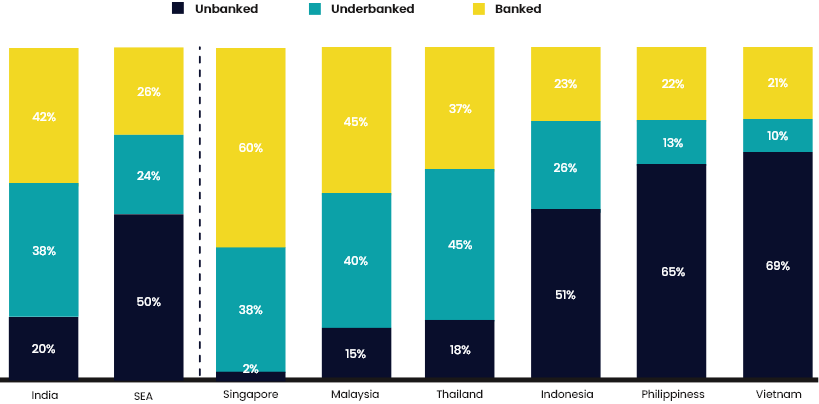

Financial Services

Share of Unbanked, Underbanked & Banked Consumers in Southeast Asia (SEA)

Source: Bain&Company, Google, Temasek, 2019

Agriculture

The agricultural sector is a central pillar of the Indian & Southeast Asian economies, employing 40-50% of the workforce and providing a significant contribution towards the GDP. However, productivity and yield remain a challenge, and hence poverty and malnutrition in rural areas remains high. In addition, water shortages, a changing climate, and fragmented land holdings make it difficult for millions of smallholder farmers to feed their families, much less earn a profit from their labour.

Below are some aspects of indian agriculture that need to be addressed :-

Employer Rationalization

Agriculture sector employs 43% of India’s Workforce, contributing only 16% to GDP

Financial Service

Lack of adequate data prevents the adoption of financial services such as credit and insurance

Supply Chain

Post harvest losses in India amounts to US $13 billion

Market Linkage

Farmers are unable to get fair price due to limited sales channel

Digital Infrastructure

Data and digital records of transitions limited across the agriculture value chain

Land Degradation

Farmers are not educated enough to use fertilisers efficiently, leading to worsening soil quality

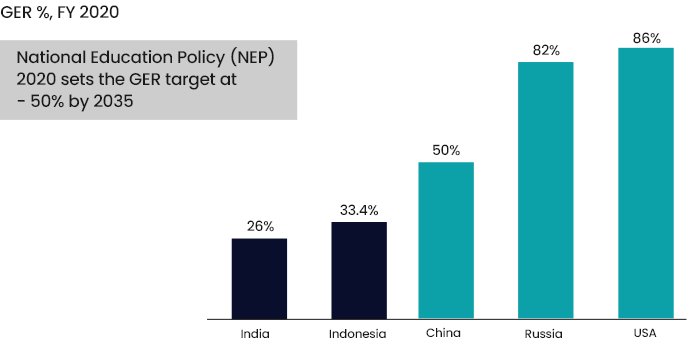

Education

Both India and Southeast Asia have some of the youngest demographics in the world and with a median age below 30 years, a significant part of the population is of the education age-group. However, the gross enrollment ratio (GER) for primary education in these geographies remains below 30%, which is much lower than the ~70% GER seen in developed parts of the world. With over 500 million people in the primary and secondary education bracket, providing access to quality education remains one of the largest challenges facing nations in the region. The need for quality online education has become more apparent since COVID19 closed traditional schools and Universities for over 18 months.

In Indian higher education stands at 26% in 2020, lagging substantially Behind other nations

GER (Gross Enrolment Ratio)

Source: RedSeer, UNESCO Institute, 2020

Logistics & Warehousing

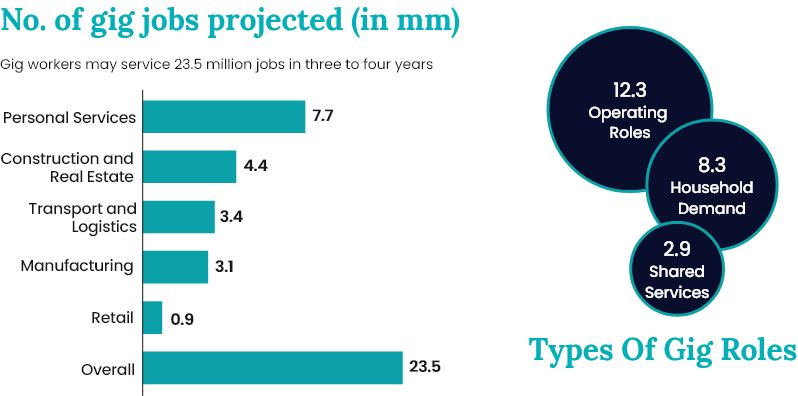

The global average contribution to GDP of the Logistics sector is ~6-8%, however, in India and Southeast Asia, this figure is anywhere between 10-15%. Additionally, logistics as a sector is responsible for a significant portion of employment in these geographies and is the leading employer of blue and grey collared workers. Digitization and removal of inefficiencies from the sector clubbed with modernization of regulations and private intervention could potentially catalyze job creation, formalization of the blue-collar workforce as well as provision of necessary social benefits.

Growing Gigs

Construction, manufacturing, retail, transportation and logistics sectors may create around 70 million ‘gigable’ jobs within 8-10 years.

Source: Unlocking the Potential of Gig Economy in India Report, BCG, 2021

E-commerce

46% SMEs had increase in sales with online marketplace listing in 2020. Adoption of e-commerce is also able to boost profit margins by up to 49% as a result of overhead costs and upfront capital investment

Source: The Internet Economy in the G20, BCG

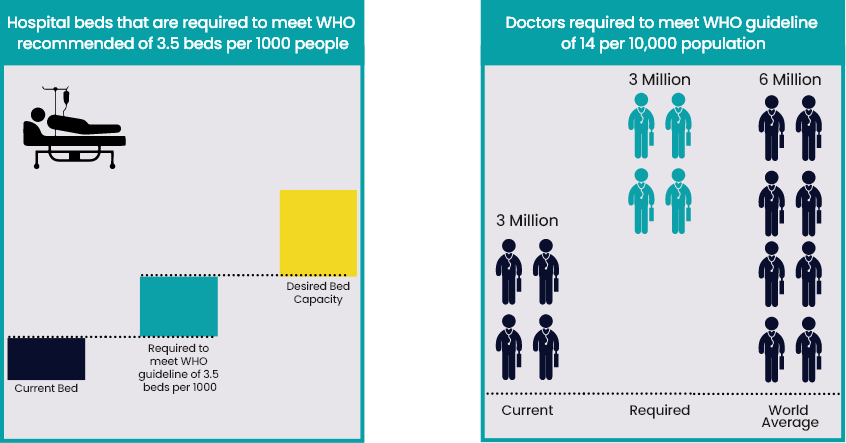

Healthcare

World Health Organisation, 2020

![]()

Beyond direct impact

The problems facing nations like India and in Southeast Asia stretch beyond direct tangible impact and the sometimes-rigid social fabric of these countries causes deep-rooted issues. We at Earlsfield Capital believe that although direct impact is measurable, we will consistently strive to create formal frameworks for problems that go beyond economical gains and address social and societal constraints. Gender equality and minority representation warrants continuous focus, not just through our investments, but through added initiatives that catalyze the journey to equality and uniformity versus marginalization.

We invest in companies and sectors that have the potential to create mass impact across the value chain and make a fundamental difference to people’s lives. Our decisions on investment sectors are in line with ‘Social Development Goals’ designed by the United Nations, that recognize the world’s most important global challenges.